Abstract

Over the years, the nature of dividend payment of quoted non-financial firms in Nigeria has been observed: while some firms pay a dividend, others are not regular and some do not pay at all. The general objective of this research, therefore, is to determine the factors (previous dividend, return on assets, financial leverage, firm growth, tax, firm age, and firm size) responsible for the variance in payments of divided among the quoted non-financial firms in Nigeria. This study adopts the ex- post facto research design. The population for the study is the quoted non-financial firms on the Nigerian Stock Exchange (NSE) from 2010 through 2019. There were a hundred and thirteen (113) firms. The purposive sampling technique is employed based on firms with records of declaration of dividend payment for at least six years within the period under review (2010-2019). On this basis, a total of fifty-three (53) firms spread across the ten (10) sectors were selected to form the sample size of the study. Secondary data was collected from the firms’ published annual reports. The panel regression model was used to estimate the data. After the Hausman test was conducted, the fixed-effect statistical model was adopted for the overall model of quoted non-financial firms in Nigeria. After the test of hypotheses, the results reveal financial leverage, tax, firm size, previous dividend, and return on assets have a significant and a positive effect on dividend payout in descending order. While firm age and firm growth have an insignificant effect. It is recommended among others, that the board of directors and the management should be mindful of the obligation to bondholders and not concentrate only on paying a dividend to shareholders only.

Keywords: Dividend Policy, Dividend Payout, Previous dividend, Return on Assets, Financial Leverage.

Download the file by clicking here:

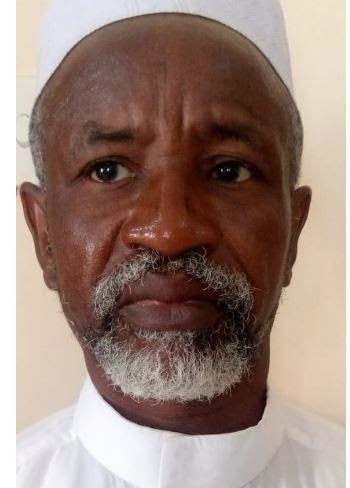

author/Prof. Fodio I. Musa et al

journal/Zamfara IJOH Vol. 1 Issue 3

pdf-https://drive.google.com/file/d/1afLaX56K9UX7eKdmFN97P0PH__884Waq/view?usp=share_link

paper-https://drive.google.com/file/d/1afLaX56K9UX7eKdmFN97P0PH__884Waq/view?usp=share_link