Abstract

This study determined the extent to which gender diversity and CEO duality influences tax avoidance decisions of quoted consumer goods manufacturing companies in Nigeria. Fifteen (15) quoted consumer goods manufacturing companies on the Nigeria Stock Exchange as at 2021 were selected for this study. Both Ex-post- facto and Causal Research Designs were adopted in the study. Panel data obtained from the annual reports of the selected firms for the period of 7 years (2015 to 2021) was used to examine the relationship between the variables. The output of multiple regression model employed to test the hypothesis indicated among other things that gender diversity had significant negative effect on tax avoidance decisions of the studied firms, but CEO duality has significant positive effect on tax avoidance decisions of the firms. Thus, the study recommends that the management of quoted consumer goods manufacturing companies in Nigeria; should reduce the dominance of female participation on the board of their companies because their inclusion is creating negative consequences on the company tax liabilities and that the companies should continue with the policy of CEO duality because it leads to higher levels of tax efficiency.

Keywords: Board diversity, tax avoidance, gender diversity, CEO duality

Download the file by clicking here:

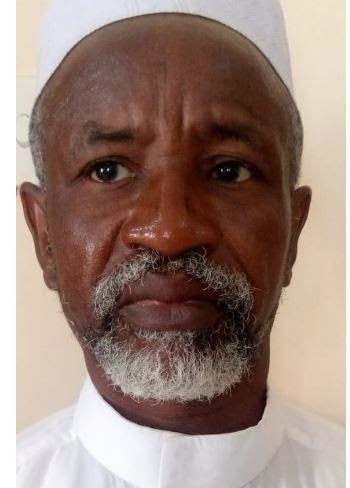

author/Ismail Abdul-khadir Musa et al

journal/Zamfara IJOH Vol. 1 Issue 3

pdf-https://drive.google.com/file/d/10iO8icfTmuYsy8mxsnA1ebwrAalrTYWj/view?usp=share_link

paper-https://drive.google.com/file/d/10iO8icfTmuYsy8mxsnA1ebwrAalrTYWj/view?usp=share_link